ADVERTISEMENT

WHEREVER YOU ARE, BKT IS WITH YOU

A LONG WAY TOGETHER

matter how challenging your needs, BKT is with you offering an extensive product portfolio for every field such as agriculture, OTR and industrial applications. BKT provides concrete, reliable and high-quality solutions to your requests and working needs. Wherever you are, BKT is with you. BKT USA Inc. 202 Montrose West Ave. Suite 240 Copley, Ohio 44321 Toll free: (+1) 888-660-0662 - Office: (+1) 330-836-1090 Fax: (+1) 330-836-1091 Discover the BKT Radial Range

No

WHY YOU SHOULD OFFER ALTERNATIVE FINANCING CONSUMERS ARE LOOKING FOR FLEXIBLE OPTIONS

BIG TRENDS IN WINTER TIRES WILL ALL-WEATHER TIRES BITE INTO WINTER TIRE SALES?

THE DAUNTING ROLE OF SERVICE MANAGERS

BALANCING SPEED, ACCURACY AND PERSONNEL IS ESSENTIAL

HOW TO MANAGE YOUNG TECHNICIANS

Tire dealers share what works for them

March 2024 | Vol. 105, No. 3 | $10 | www.moderntiredealer.com

TRANSAMERICA TIRE CO.,LTD. 5118 PARK AVE., SUITE 601, MEMPHIS, TN 38117 marketing@transamericatire.com @PREDATORTIRES 626-536-2339 WWW.PREDATORTIRES.COM

4

6

8

16

Recent

News

Plaintiffs

46

Reasons

Half

Free

3 www.ModernTireDealer.com The Industry’s Leading Publication March 2024, Volume 105, Number 3 Modern Tire Dealer is a proud member of:

Editorial

averted

Disaster

bills would have hurt tire dealers, manufacturers

moderntiredealer.com

and navigation tools

MTD’s website

for

Industry News

accuse tiremakers of price xing Californian,

class action status

Ohioan seek

Numbers That Count

statistics for an industry in constant motion

Your Marketplace Dealers say tier-one prices are ‘too high’ Tiremakers balance volume and price

Business Insight

daunting role of service managers Balancing speed, accuracy and personnel is essential

Dealer Development

responsible for training, culture at your dealership

are simple, easy nor cheap to develop

Relevant

18

42

The

44

You’re

Neither

Mergers and Acquisitions

why M&A deals died

2023

in

were nancial and half weren’t

EV Intelligence

48

coffee, free EV charging

they worth it?

Focus on Dealers K&M Tire ‘levels up’ distribution, customer service

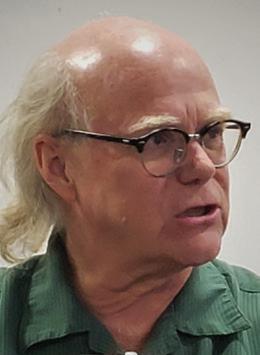

enhancements are on the way, says Gossard 52 Focus on Dealers Black’s Tire stays true to core values ‘We want to set the pace’ 54 Focus on Dealers WTD plans for ‘substantial growth’ Expanding distribution, product range are big priorities 55 TPMS 2023 Mazda CX-5 58 Ad index On the cover: Eric Krebsbach, Black Hills Tire (Rapid City, S.D.) DEPARTMENTS 20 How to manage young technicians Tire dealers share what works for them 24 Big trends in winter tires Will all-weather tires bite into winter tire sales? 36 Why you should offer alternative nancing Consumers are looking for exible options 40 Maintaining brakes, rather than xing them Tire dealers adapt to meet demands FEATURES 40 Brake service is a longstanding and essential piece of the automotive service menu at tire dealerships around the country. At Eastern Tire & Auto Service Inc. in Maine, President Alvin Chase says brake jobs represented almost 19% of his auto service business in 2023. Photo:

Tire

Auto Service

Are

50

Other

Eastern

&

By

IMike Manges

IMike Manges

Disaster averted

RECENT BILLS WOULD HAVE HURT TIRE DEALERS, MANUFACTURERS

ndependent tire dealers in Washington state narrowly avoided the heavy hammer of bureaucracy when two bills that would have curtailed their ability to do business stalled before they could be signed into law. If ratified, Washington House Bill 2262 and its companion, Washington Senate Bill 6304, would have been disastrous for tire dealers in the state.

The back-to-back bills also would have placed expensive, unfair burdens on tire manufacturers by establishing completely unnecessary consumer tire rolling resistance regulations.

And frighteningly enough, this only would have been the tip of the iceberg.

Senate Bill 6304, whose language, in some cases, was identical to the verbiage found in House Bill 2262, also called for:

• The creation of a database of replacement tires offered for sale or distribution in the state of Washington;

• “Requirements for any tire brand name owners and tire manufacturers with replacement tires in production offered for sale or distribution in the state to report information” to Washington state officials;

• The establishment of a rating system that would denote the energy efficiency of replacement tires “based on their rolling resistance coefficient,” with ratings displayed for consumers at the point of sale, and;

• The establishment of testing procedures “in alignment with enacted regulations by the National Highway Traffic Safety Administration.”

The bill would have given the Washington State Department of Commerce the ability to prohibit the sale of replacement tires that did not meet minimum energy efficiency standards mandated by legislators and would have allowed inspections of replacement tires to be conducted.

It also would have given the Washington State Department of Commerce — “or another state agency, as designated by the department” — the ability to issue warnings to “tire brand name owners and tire manufacturers who violate rules adopted to implement” rolling resistance regulations.

Repeat violators would have been subject to a civil penalty “ranging from $100 to $10,000 per occurrence,” according to the bill’s verbiage.

Furthermore, the bill encouraged the Washington State Department of Commerce “to coordinate with the California Energy Commission” in order to “pursue common standards, reporting requirements and labeling that reduces compliance costs for the (tire) industry.”

You might remember that the state of California has been looking to establish its own set of consumer tire rolling resistance mandates.

Both the U.S. Tire Manufacturers Association (USTMA) and the

Tire Industry Association (TIA) were quick to state their opposition to both pieces of legislation.

The USTMA said it opposed provisions in the Senate bill that would have granted “authority to the state’s Department of Commerce to make significant decisions about how tires are manufactured, sold and used in the state.

“The flawed proposal would severely reduce the selection of tires available to consumers and disadvantage Washington tire retailers, leaving consumers to travel to neighboring states to find the tires that meet their driving and vehicle needs.

“The misguided policy also incentivizes market decisions by some tiremakers that could adversely impact the safety and longevity of tires available for sale in Washington by reducing tread depth and decreasing wet traction performance, in turn increasing the number of waste tires produced in the state each year.

“Reduced selection will mean higher prices, which will have a disparate effect on more price-sensitive consumers, leading to increased purchases of unsafe used tires.

“Lastly, the proposed policy does not account for legitimate vehicle applications where a tire’s traction performance is more important than fuel efficiency.”

In a statement, TIA said it was “deeply concerned by the potential consequences” of Senate Bill 6304.

“Much like the House bill, there are concerted efforts to advance an agenda that contradicts our stance on safeguarding a retailer’s right to sell certain tires and ensuring consumer freedom in choosing their preferred tires.”

Emboldended by Washington and California’s efforts, could other states introduce their own bills? It will be our duty as an industry to remain vigilant and fight against the imposition of similar directives. ■

If you have any questions or comments, please email me at mmanges@endeavorb2b.com.

MTD March 2024 4 Editorial

Two recent bills in the state of Washington would have been bad news for tire dealers and manufacturers.

Photo: Hey Darlin | 455322783 | Gettyimages.com

ModernTireDealer.com

DIGITAL RESOURCES FOR THE INDEPENDENT TIRE DEALER

Stay tuned to MTD’s podcast!

The Modern Tire Dealer Show is available on Apple Podcasts, Spotify, Google Podcasts, iHeart Radio, Amazon Music, Audible and MTD’s website. Download it today!

Sign up for Modern Tire Dealer ’s eNewsletters to receive the latest tire news and our most popular articles. Go to www.moderntiredealer.com/subscribe

The new year has already brought about a few acquisitions, including one in Canada, where Coast Tire & Auto Service has merged with Andy’s Tire Group. Combined, the companies operate 46 stores, three retread plants and three distribution centers.

Photo: Coast Tire & Auto Service

Prices and profits matter

It’s no surprise that tire dealers are tuned into talk about tire prices. But the interest in that topic may have hit an all-new high with the February filing of a lawsuit that accuses six of the world’s largest tire manufacturers of price fixing. (Read more of the details on page 8.) The suit comes as analysts expect tire prices to fall in 2024.

1. Plaintiff accuses tiremakers of price fixing

2. Photos: Behind the scenes at K&M Tire’s dealer conference

3. New Goodyear CEO: ‘Streamlining the portfolio’ is one focus

4. Coast Tire to merge with Andy’s Tire Group

5. Will tire prices come down in 2024?

6. Goodyear posts fourth quarter results

7. Ziegler Tire President Bill Ziegler dies

8. K&M Tire ‘levels up’ its distribution, customer service

9. Healy talks top exec changes at Goodyear

10. New Senate bill targets tires in Washington state

DIGITAL EDITION

Check out MTD ’s digital edition at the top of our website’s homepage.

SOCIAL MEDIA

Like us Facebook: facebook.com/ ModernTireDealer

3515 Massillon Rd., Suite 200 Uniontown, OH 44685 (330) 899-2200, fax (330) 899-2209 www.moderntiredealer.com

PUBLISHER

Greg Smith

gsmith@endeavorb2b.com (330) 598-0375

EDITORIAL

Editor: Mike Manges, (330) 598-0368, mmanges@endeavorb2b.com

Managing Editor: Joy Kopcha, (330) 598-0338, jkopcha@endeavorb2b.com

Associate Editor: Madison Gehring, (330) 598-0308, mgehring@endeavorb2b.com

PRODUCTION

Art Director: Erica Paquette

Production Manager: Karen Runion, (330) 736-1291, krunion@endeavorb2b.com

ACCOUNT EXECUTIVES

Darrell Bruggink

dbruggink@endeavorb2b.com (608) 299-6310

Marianne Dyal mdyal@endeavorb2b.com (706) 344-1388

Sean Thornton

sthornton@endeavorb2b.com (269) 499-0257

Kyle Shaw kshaw@endeavorb2b.com (651) 846-9490

Martha Severson mseverson@endeavorb2b.com (651) 846-9452

Chad Hjellming chjellming@endeavorb2b.com (651) 846-9463

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix Performance

John McCarthy Jr., McCarthy Tire Service Co. Inc.

Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE

(877) 382-9187

moderntiredealer@omeda.com

ENDEAVOR BUSINESS MEDIA, LLC

CEO: Chris Ferrell

President: June Griffin

COO: Patrick Rains

CRO: Paul Andrews

Chief Digital Officer: Jacquie Niemiec

Chief Administrative and Legal Officer: Tracy Kane

EVP Transportation: Kylie Hirko

VP Vehicle Repair: Chris Messer

VRG Editorial Director: Matthew Hudson

Follow us X: twitter.com/ MTDMagazine @MTDMagazine

warrant any views or opinions by the authors of said articles.

6 MTD March 2024

Modern Tire Dealer (USPS Permit 369170), (ISSN 0026-8496 print) is published monthly by Endeavor Business Media, LLC. 201 N Main St 5th Floor, Fort Atkinson, WI 53538. Periodicals postage paid at Fort Atkinson, WI, and additional mailing offices. POSTMASTER: Send address changes to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject non-qualified subscriptions. Subscription prices: U.S. ($81.25 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. Customer service can be reached toll-free at 877-382-9187 or at moderntiredealer@omeda.com for magazine subscription assistance or questions. Printed in the USA. Copyright 2024 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as official expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so

Plaintiffs accuse tiremakers of price fixing

CALIFORNIAN, OHIOAN SEEK CLASS ACTION STATUS

Weeks after a complaint accusing six tire manufacturers of price fixing was filed in the U.S. District Court for the Southern District of New York, a second suit was filed in Ohio.

In the initial case, Plaintiff Rena Sampayan is seeking class action status. She accuses Bridgestone Americas Inc., Continental Tire the Americas LLC, Goodyear Tire & Rubber Co., Michelin North America Inc., Nokian Tyres Inc., Pirelli Tire LLC and unnamed “doe defendants” of violating the Sherman Act by establishing “an unlawful agreement … to artificially increase and fix the prices of new replacement tires for passenger cars, vans, trucks and buses sold in the United States.” (The second case, filed by John “Jack” Bengel, is nearly identical to the first and names the same tiremakers.)

Those “doe defendants” refer to “other individuals or entities who engaged in or abetted the unlawful conduct” of the already named tiremaker defendants. The first suit, filed on Feb. 7, may be amended to add names of additional defendants.

Sampayan is a resident of California, who according to the complaint, bought tires in her home state from Goodyear.

In seeking class action status, her case looks to represent those who have purchased tires from the aforementioned tire companies in the U.S. since Jan. 1, 2020. And though the exact number of affected parties is unknown, the petition notes that due to the nature of the product and business, there are potentially “millions” of class members throughout the country.

The action alleges that the six tiremakers “coordinated price increases, including through public communications,” and states that the allegation is “supported by, among other things, defendants’ sudden and dramatic parallel price increases, which absent a conspiracy to fix prices, ran contrary to their economic interests;

EC (European Commission) dawn raids of defendants; the high level of market concentration in the tire market; significant barriers to entry; lack of economic substitutes for tires; standardization of tires with a high degree of interchangeability; and the myriad opportunities that employees of defendants had to conspire with one another to fix prices of tires.”

The complaint questions whether the tiremakers “conspired with one another to restrain (the) trade of tires” and whether their conduct “caused the prices of tires sold directly to wholesalers, retailers and consumers to be higher than the competitive level.”

The suit lists 31 price increases that were put in effect for replacement passenger and light truck tires from 2021 to 2023.

The suit also notes that prices have remained high even as inflation and the effects of the COVID-19 pandemic have eased and that certain tiremakers have noted positive outcomes in various earnings reports.

Goodyear, for example, noted in the first quarter of 2022 that its price hikes “more than offset” its costs. And Conti-

nental reported that its (automotive) sales volume increased by 19.3% in 2022.

As to why tiremakers would allegedly resort to price fixing, the complaint accuses the six tiremakers that were named of looking for a path to profitability following the pandemic.

When domestic travel was hampered by measures to combat the spread of the virus, the demand for tires was reduced.

Supply chain issues and higher costs “caused profit to shrink” even as travel began to rebound.

“To remain profitable, defendants needed to pass on these costs to consumers,” the suit alleges.

The case seeks to represent those “that purchased tires directly from defendants at supercompetitive prices to recover treble damages, injunctive relief and other relief as appropriate, based on defendants’ violation of federal antitrust laws.”

When reached for comment, a Michelin spokesperson said that “Michelin strictly complies with antitrust laws in all countries where it operates. We will cooperate with regulators and defend ourselves in any litigation that is filed.”

A spokesperson for Nokian confirmed the suit and said, “We always operate in compliance with laws and regulations, ensuring everything is done correctly. We comply with relevant anti-trust laws and do not tolerate any violations of them.”

A spokesperson for Continental said, “Integrity is an integral part of Continental’s corporate culture and is anchored in our code of conduct, which applies to all Continental companies worldwide. We have a zero-tolerance policy when it comes to compliance and thoroughly follow up on and investigate all alleged allegations. Our policy (is) to not comment regarding active litigation.”

Spokespeople for Pirelli and Bridgestone said their companies do not comment on litigation.

Industry News

MTD March 2024 8

Class action lawsuits filed against six tiremakers claim they violated antitrust laws and colluded on tire prices in an effort to boost profits.

Photo: MTD

Bites Industry News

Titan acquires Carlstar

Titan International Inc. has bought Carlstar Group LLC for $296 million in cash and stock. The deal includes four Carlstar plants and 12 distribution centers across North America and Europe. It also diversifies Titan’s product portfolio into new categories.

Gill’s acquires Berg Tire

Gill’s Point S Tire & Auto Service, which is based in The Dalles, Ore., has acquired Glendive, Mont.-based Berg Tire Inc. Berg Tire was a single-location dealership and had been owned by Matt Berg and his father, Jay Berg, who expanded the shop over the years.

Touchette to add D/C

Groupe Touchette Inc. has acquired 6.6 acres of land to construct a 112,000-square-foot distribution center at CentrePort Canada, an inland port and foreign trade zone. The new facility will bring the company’s total space to 212,000 square feet on 12.6 acres in Brookside Industrial Park West, located in Rosser, Manitoba.

Chandgie promoted at YTC

Yokohama Tire Corp. has promoted Stan Chandgie from executive vice president of sales and support to chief operating officer, effective April 1, 2024. In his new role, Chandgie will retain oversight of consumer and commercial sales, and add marketing, tire business planning and supply chain/logistics to his responsibilities.

Hino picks Hankook

Hino Trucks and Hino Canada have selected Hankook Tire America Corp.’s AH37 and DL11 TBR tires for the U.S. and Canadian markets. The medium truck maker will offer Hankook’s AH37 and DL11 tires in its L Series models.

Ascenso names president

Ascenso Tires North America has named Thomas Clark as its new president, effective Feb. 14, 2024. Clark has been in the industry for three decades and has worked at the Michelin Group and the Carlstar Group. In his new role, Clark will oversee and manage operations in the U.S. and Canada.

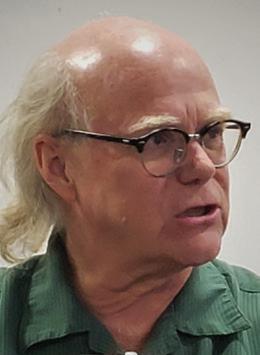

Ziegler Tire President Bill Ziegler dies

Bill Ziegler, longtime president of Massillon, Ohiobased Ziegler Tire & Supply Co. died Jan. 29. He was 75 years old.

Born to Herbert and Gervasa Ziegler, Bill, after graduating from The Ohio State University and working as an accountant, joined Ziegler Tire, his family’s business, in 1975.

Bill became president of Ziegler Tire in 1999. Under his direction, the dealership, which was founded in 1919, has grown to encompass nearly 30 stores and three distribution centers across multiple states.

“Bill is a true leader,” Harold Ziegler Jr., then Ziegler Tire’s assistant treasurer, told MTD in 2009, after Bill was named MTD’s Tire Dealer of the Year.

Harold credited Bill with being the catalyst behind the company’s growth and success.

Ziegler Tire’s employees “look up to him. They know (Bill is) responsible for keeping the company together and he’s done a darn good job.”

“There’s a presence about him that when you step between the lines for that game every morning at 7 o’clock, you know what you have to do,” John Ziegler Jr., vice president of Ziegler Tire, said about Bill. “You’re doing it for him, but he’s doing it for the company.”

“Relationships are very important to Bill — not only with the tire manufacturer, but with the consumer and even his community,” said John Baratta, then-president, consumer replacement tire sales, for Bridgestone Americas Tire Operations LLC.

“Bill is the type of person you’re proud to be friends with,” Francois Corbin, thenchief operating officer for Michelin Americas Truck Tires, also told MTD in 2009. “He has very strong personal values, ethics and credibility.”

Wonderland Tire buys Carter Tire

Byron Center, Mich.-based Wonderland Tire Co. has acquired Carter Tire & Automotive, which is located between Wonderland Tire’s stores in western Michigan and its Chicago, Ill., store.

“This strategic move marks a significant milestone in Wonderland Tire’s ongoing commitment to growth,” say Wonderland Tire officials.

“The acquisition of Carter Tire & Automotive will give Wonderland Tire a step into a new area and market,” with Dave Langerak, Wonderland Tire’s chief operating officer, calling the newly acquired dealership “a nice fit.”

Carter Tire & Automotive is based in Elkhart, Ind.

“The acquisition of Carter Tire & Automotive will give Wonderland Tire a step into a new area and market,” says Dave Langerak, Wonderland Tire’s chief operating officer, with Patti Piscione, former owner of Carter Tire & Automotive.

Wonderland Tire officials say they will ensure “a seamless transition for Carter Tire & Automotive, its employees and its customers. Current customers of Carter Tire can expect uninterrupted service.”

Jon Langerak, the CEO and president of Wonderland Tire, was named MTD’s Tire Dealer of the Year in 2023.

10

Under the late Bill Ziegler’s direction, Ziegler Tire & Supply Co. grew to encompass nearly 30 stores and three distribution centers across multiple states.

Photo: MTD

MTD March 2024

Photo: Wonderland Tire Co.

WHEREVER YOU ARE, BKT IS WITH YOU

A LONG WAY TOGETHER

matter how challenging your needs, BKT is with you offering an extensive product portfolio for every field such as agriculture, OTR and industrial applications. BKT provides concrete, reliable and high-quality solutions to your requests and working needs. Wherever you are, BKT is with you. BKT USA Inc. 202 Montrose West Ave. Suite 240 Copley, Ohio 44321 Toll free: (+1) 888-660-0662 - Office: (+1) 330-836-1090 Fax: (+1) 330-836-1091 Discover the BKT Radial Range

No

Bites

Pirelli hits milestone

Pirelli & Cie SpA’s Guanajuato, Mexico, consumer tire plant has produced its 50-millionth tire. The plant, which opened in 2012, focuses on “the high value segment”— specifically, high performance and ultra-high performance tires for cars, electric vehicles, light trucks and SUVs, say Pirelli officials. Pirelli also has opened its first training center in Mexico, which will help develop local talent.

Chapel Hill Tire partners

Chapel Hill Tire has announced its partnership with the North Carolina Triangle Apprenticeship Program. The program starts from 11th to 12th grade and spans four years with academic learning and hands-on training. Participants will work towards an associate degree at a local community college and gain paid on-the-job experience at Chapel Hill Tire’s facilities.

NETSA plans event

The New England Tire and Service Association (NETSA) will hold its annual trade show and education event on April 5-6 in Uncasville, Conn. The trade show and seminars are open to all active automotive, tire and service providers, owners, managers and service staff. The event will also feature inductions into the NETSA Hall of Fame, as well as a scholarship auction.

Etheridge joins CMA

CMA LLC/Double Coin has named Patrick Etheridge a regional sales manager for its Mid-South and Rocky Mountain regions. Etheridge worked at Bridgestone Americas Inc., Giti Tire (USA) as a key client leader and at Prinx Chengshan Tire North America Inc. as that company’s vice president of sales.

Toyo pairs with BMW

Toyo Tire U.S.A. Corp. has announced a new multi-year agreement with BMW Car Club of America that extends through 2026. Toyo will continue to support the BMW Club Racing segment and is also expanding its contingency sponsorship with a payout program available for E30, E36 and E46 Spec classes and non-spec classes.

Longer wait for Thailand tariff decision

The preliminary phase of the investigation by the U.S. Department of Commerce to determine whether tariffs should be levied against truck and bus tires from Thailand has been extended slightly.

The United Steelworkers union requested and was granted an extension in the case. Lawyers for the union petitioners asked for the extension due to the “complexity of the issues presented in this investigation.”

Requests for extensions and them being granted are common in these causes.

As a result of this request, the Department of Commerce is pushing out the deadline by another 50 days. The new preliminary ruling is due by May 14.

Once the preliminary ruling is issued, the case moves on to a “final” phase. Unless an additional extension is granted — and that’s possible, too — the final determination would come 75 days after the preliminary ruling is issued.

ZC Rubber considers plant in Mexico

Zhongce Rubber Group Co. Ltd (ZC Rubber) wants to build a tire factory in Mexico to serve the North American market.

The tiremaker says it is looking to establish a 6.5 million square-foot plant in Saltillo, Mexico, along with an on-site warehouse to serve the North American market “to improve (our) local distribution network and optimize cost efficiency.”

In Saltillo, ZC Rubber says the plant would be about 150 miles from the U.S.-Mexico border, which “makes it an ideal choice to meet the dynamic demands of both the Mexican and North American markets.”

In a statement from the tiremaker, Henry Shen, vice president of ZC Rubber, said, “Our plan to open a tire factory in Mexico demonstrates our commitment to meeting the growing demand for high-quality tires in the region. While we explore this opportunity, we remain focused on our customers’ needs and operational efficiency by setting up a complete local distribution network.”

K&R opens Goodyear retread plant

There’s a new Goodyear retread plant at K&R Truck Sales in Flint, Mich. The plant features “state-of-theart equipment and an experienced staff with several decades of experience,” according to K&R officials.

The facility can retread radial commercial truck tires with sizes ranging from 225/75R16 through 445/65R22.5, as well as OTR tires, while providing section repairs on ag and earthmover tires. It also offers wheel reconditioning, forklift tire pressing and other services.

K&R sells Goodyear, Roadmaster and Cooper brand tires, plus other tire brands, and provides emergency road service.

“We are excited to expand our tire operations into the retread market,” says Ed Rietman, owner of K&R.

MTD March 2024 12

Industry News

ZC Rubber says it is contemplating another new tire factory. This one would be built in Mexico and designed to serve the North American market.

Photo: ZC Rubber

K&R Truck Sales has opened a Goodyear retread plant in Flint, Mich.

Photo: K&R Truck Sales

Start Earning Dollars for Each Tire You Sell! As a Maxxis Accelerate dealer, you will have unlimited access to a wide spectrum of rewards, promotions and support from a global tire leader. EARN REWARDS ACCELERATE SALES GET STARTED TODAY! SCAN ME

Bites

Arroyo names ambassadors

Arroyo Tires has announced an exclusive partnership with three brand ambassadors for the year 2024. The three influencers are James Outman, center fielder for the Los Angeles Dodgers; Adam Waheed, comedian and social media influencer; and Parker Nirenstein, automotive YouTuber and owner of Vehicle Virgins YouTube channel.

New Cosmo store opens

Miami, Fla.-based Tire Group International LLC (TGI) has added another location to its Cosmo retail store network in Santa Elena del Uairen, Venezuela. The store is a collaboration with longtime partner BV Pneus. TGI’s first Cosmo store opened in Florida last summer.

Ascenso sets campaign

Ascenso Tires North America has launched a new campaign, Tracks of Triumph, to celebrate the company’s channel partners. In the campaign, the channel partners discuss how the brand’s products and services help them achieve their goals.

Veterans to consult

MK Value Creation Advisors is a consultancy founded by industry veterans Marty Krcelic and Tim Miller. They assembled a team of five executives with a common vision for delivering tailored solutions to drive value for businesses and private equity investors. The team members previously collaborated for many years at TBC Corp.

Turbo partners with Rams

Turbo Wholesale Tires LLC announced a brand partnership with Kyren Williams, running back for the LA Rams football team. Williams will serve as the official ambassador for Turbo Wholesale Tires’ Lexani performance tire brand. His teammate, Cooper Kupp, was Lexani’s previous brand ambassador.

SRNA promotes Johnson

Sumitomo Rubber North America Inc. (SRNA) has promoted Tsuyoshi “TJ” Johnson to director of product planning for the company’s Falken passenger and light truck tire lines. He joined SRNA nearly eight years ago.

Sun Auto moves into Ohio

Sun Auto Tire & Service Inc. has acquired seven-location Boyd’s Tire & Service in central Ohio.

The acquisition marks the Tucson, Ariz.-based company’s entry into the state. “Boyd’s being welcomed into the Sun Auto family is a milestone in our growth journey,” says Tony Puckett, CEO of Sun Auto Tire & Service.

“We are thrilled to make our first entrance into Ohio, which is a region that is going to be very important to our plans going forward. I can’t wait to welcome these new members of the Sun Team into our group.”

“Joining forces with Sun Auto is a promising development for Boyd’s,” says Gary Taylor, district manager for Boyd’s Tire & Service.

“We’re excited to integrate our commitment to excellence and service passion with the horsepower that Sun Auto has demonstrated through their growth. Our teammates are the most important facet of our business and we’re thrilled to have chosen Sun Auto as a trusted partner for their continued benefit.”

VIP sets new donation record

VIP Tires & Service announced employees donated more than $275,000 to Make-A-Wish in 2023.

This brings VIP Tires’ total contribution in recent years to over $1.275 million for Make-A-Wish.

“In 2023, the VIP team took our support for Make-A-Wish to an entirely new level, setting a new record with over $275,000 in contributions to one of the world’s most impactful charities,” says Tim Winkeler, president and CEO of VIP.

“VIP keeps proving that businesses large and small can play a pivotal role in helping those in need and I couldn’t be prouder of our employees for supporting such a noble cause. Doing the right thing goes a long way and we can’t wait to support Make-A-Wish to an even larger extent in the years ahead — hopefully setting more records along the way.”

“These funds will directly impact the lives of children battling critical illnesses throughout northern New England and in turn, (will) spread hope and joy throughout so many local communities,” says Kate Vickery, president and CEO of Make-AWish Maine.

Bridgestone puts winter tires to test

Bridgestone Americas Inc. recently put its Blizzak line of winter tires through the paces at its winter driving school in Steamboat Springs, Colo. During the event, Bridgestone also provided an overview of tires that feature its ENLITEN technology.

MTD March 2024 14

Industry News

Tim Winkeler, left, president and CEO of VIP Tires & Service, along with, back row from left, Rob Kaffel, region director for VIP, and John Quirk, owner and chairman, present the 2023 donation to Make-A-Wish Maine President and CEO Kate Vickery. Also pictured, at right, is VIP Senior HR Manager Mary Daigle.

Photo: VIP Tires & Service

Photo: MTD

Numbers ThatCount

Relevant statistics from an industry in constant motion

13.86 MILLION

Number of commercial trucks registered in the U.S.

Source: American Trucking Associations

TravelCenters of America

$200 MILLION

2024 investment in grants for apprenticeship programs in in-demand industries, including transportation and manufacturing.

5,418

Source: U.S. Department of Labor

Canadian Treads Corp.

Number of service trucks operated by the nation’s ve largest commercial tire dealers in 2023.

Source: MTD Top 25 Independent Commercial Tire Dealers List

5.3%

Source: IMR Automotive Research

Photo: MTD

Percentage drop in consumers since 2013 who turn to car dealerships for automotive service.

4.3%

Overall growth of the technician workforce from 2021 to 2022.

Source: TechForce Foundation’s 2023 Technician Supply & Demand Report

MTD

16

Photo:

Photo: MTD

MTD March 2024

Photo:

Photo:

BANDITTIRES.COM TO BECOME A DEALER CALL 305.621.5101 SEVERE SNOW RATED SCAN FOR MILEGAGE WARRANTIES

By

John Healy

John Healy

RDealers say tier-one prices are ‘too high’

TIREMAKERS BALANCE VOLUME AND PRICE

etail sellout trends in January 2024 were slightly negative following positive sellout trends in the month of December. On average, dealers saw retail unit sales fall 0.4% year-over-year in January, following a 1.1% gain in December.

Regionally, the Northwest saw the strongest trends, up double digits compared to a year ago. That growth was driven by weather — specifically, heavy snowfall. That said, the Midwest, Northeast, Southeast and Southwest regions all saw volumes on the negative side of the ledger in January. The Southeast saw the softest trends, with volume down 6.3% in the month.

Seven percent of our dealer contacts reported negative demand in January, a sequential improvement from the 25% of our contacts who saw negative demand in January 2023. Those who experienced heavy snowfall reported a sharp increase in demand during the month.

Apart from weather-driven trends, tire dealers report sellout levels continue to be affected by elevated tire prices and the macro environment, which includes a lack of rebate offers from tire manufacturers. It appears the consumer trade down and deferment cycles continue to hang over the retail tire industry.

We have long hypothesized that an acceleration of winter weather could spark a catch-up period. We’ve now begun to lap the one-year mark of soft sellout trends — with few signs of positive

momentum, except for what was recorded in the Northwest. From our view, the tire market remains in neutral to start 2024.

However, miles driven data continues to point in the right direction. Trends were positive in January for the third consecutive month.

We note that our miles driven momentum index registered a 1.7% year-overyear increase in January, following a 1.8% increase in December 2023.

While volume and demand trends are likely less than hoped for at this point in the year, we believe underlying fundamentals for tire replacement and the broader aftermarket show a healthier backdrop compared to this period one year ago.

THE PRICING QUESTION

The combined raw material costs to build a replacement tire fell an average of 0.5% in January, following a 3.3% year-over-year decline in the fourth quarter of 2023. Collectively, last year our tire raw material index fell 9.6% from 2022.

Following a year of cooling inflationary prices — every month of 2023 registered a year-over-year decline — we now see aggregate raw material prices only slightly below levels from a year ago.

We expect manufacturers will try to hold onto price as long as possible.

That said, we continue to believe there may be a level of price decreases at some point in 2024 as raw material costs stabilize

and inventory levels appear to be more normalized.

Manufacturers may concede some price to encourage tire wholesalers to begin taking on more inventory.

TIER-ONE PRICES ‘TOO HIGH’

Dealers indicate that tier-two tire brands were the most in-demand from consumers for a second straight month. Dealers continue to mention they’re seeing the effects of consumers trading down.

And several independent tire dealers noted that the elevated price point of tier-one tires is “simply too high for most consumers.”

We note tier-two brands being the most in demand matches the historical trend we’ve seen in the 10-plus years of our monthly tire surveys.

In January, tier-one brands were the least in demand, marking a fifth straight month of these brands placing last in our survey. This is the first such occurrence of tier-one in the bottom of the rankings for five or more consecutive months since August 2020 through April 2021.

During the COVID-19 pandemic, tier-one tires were in last place for nine straight months.

We remain of the view that longerterm, consumers will opt for tier-two tires as they look for a balance of price and performance.

We continue to believe the North American pricing environment will remain in line with raw material costs. We expect tier-one and tier-two tire producers to continue to be disciplined in managing the trade-off between price and volumes to maximize operating profit rather than market share. ■

John Healy is a managing director and research analyst with Northcoast Research Holdings LLC, based in Cleveland, Ohio. Healy covers a variety of subsectors of the automotive industry. If you would like to participate in the monthly dealer discussions, contact him at john.healy@northcoastresearch.com.

MTD March 2024 18 Your Marketplace

Volumes (Year-Over-Year Change) Nov-22 Dec-22 Jan-23 Nov-23 Dec-23 Jan-24 Average Increase 57% 13% 44% 50% 31% 40% 40% Flat 29% 50% 12% 10% 13% 13% 27% Decline 14% 37% 44% 40% 56% 47% 33% Total 100% 100% 100% 100% 100% 100% 100% SOURCE:

Snapshot of Dealer’s PLT Tire

NORTHCOAST RESEARCH ESTIMATES

Technician management

How to manage young technicians TIRE DEALERS SHARE WHAT WORKS FOR THEM

By

Madison Gehring

Developing a pipeline of talented, young technicians remains a challenge for many independent tire dealerships. Managing these workers once they have been hired presents another challenge.

In this MTD exclusive, Weston Chapman, owner of Rapid City, S.D.-based Black Hills Tire; Todd Ward, general manager at Chapel Hill, N.C.-based Chapel Hill Tire; Pam Konde, owner of Mac’s Tire Service in Washington, D.C.; and Alvin Chase Jr., president of Rockland,

Maine-based Eastern Tire & Auto Service Inc., discuss how they manage young technicians.

One thing they agree on is that there’s no one-size-fits-all formula.

DIFFERENT EXPECTATIONS

“I wouldn’t say there is a difference in how you manage older technicians compared to younger technicians, but there is a higher expectation of older technicians,” says Konde, whose busy, single-location dealership is open around the clock.

“For example, there is less room for careless mistakes” made by more experienced workers “because you expect these technicians to ‘know better.’”

Konde says that based on what she’s seen, older technicians come with more expectations than younger, less experienced technicians.

But Chapman of Black Hills Tire says setting expectations with your younger technicians is even more important than setting expectations with older technicians.

MTD March 2024 20

Todd Ward, general manager of Chapel Hill Tire in Chapel Hill, N.C., believes a big factor in why young people like working at his dealership is because its stores are closed on Saturdays.

Photo: Chapel Hill Tire

“Not only is it important to set expectations for your younger technicians — and communicate those expectations with them — but it’s also important that we, as managers, follow through and check up on them and those expectations,” he notes.

He says younger technicians often need more guidance and monitoring to make sure they are meeting their goals.

“It’s one of the biggest things I’ve noticed. You need to believe in them and give them a chance, but then make sure they’re following through on those expectations.”

Eastern Tire & Auto’s Chase agrees.

He says that when an older technician with experience is assigned a job, the service manager typically sets an allotted timeframe that dictates its completion.

However, that timeframe is “probably going to be different for a young person who’s starting out.”

Chase says Eastern Tire & Auto has 14 bays and 27 technicians.

“We strategically place our younger employees in between our older employees in the bays. That way, we don’t have all of

Where do you find young technicians to employ at your dealership?

our young people shoved into one corner. They are close to an experienced employee, if they were to have any questions.”

Ward of Chapel Hill Tire says it’s also important to help keep your younger employees’ expectations of themselves realistic.

“What we’ve found with our younger technicians is that they’re eager to learn and they want to learn,” says Ward.

How do you retain younger technicians at your tire

“However, they have little patience when it comes to advancing. They want to grow quickly and climb the ladder quickly.”

www.ModernTireDealer.com

21 11 2023 send pics for easy quick quotes 9 8 Hi, I need one of these I’m selling a set of each used & new take-off stock oem wheels steel / alloy we buy reconditioned, replicas, take-offs, used no core return required! we sell 1-800-383-7974 Sales@1800Ever yRim.com 1-800Ever yRim.com r y wheely big inventory! 2403MTD_1800EveryRim.indd 1 2/14/24 1:50 PM

dealership? Flexible hours/ schedule Enhanced benefits (PTO, health) Tech compensation packages Other 37% 12% 46% 5% 0 10 20 30 40 50 30% 46% 12% 12% High school vocational schools Dedicated vocational schools Tire retailers (big box stores) Other tire dealers *Data from MTD's LinkedIn. *Data from MTD's LinkedIn.

Technician management

This results in younger technicians sometimes jumping into jobs they aren’t ready for, which leads to mistakes they “beat themselves up over.

“We also have to help them manage their emotions and expectations and keep them patient,” he says.

In order to motivate his younger employees, Chapman says his dealership pays younger technicians when they work training hours to “compensate for the lack of experience and all that comes with that experience.

“This way they can take their time and really learn things the right way without having to worry about paying their bills,” which, he says, has been a big motivator.

WHAT MOTIVATES THEM?

“Our younger employees are definitely driven and motivated by money because housing and living are so expensive right now,” says Ward.

Chase agrees and says his younger employees care more about hourly wages than 401(k) plans or health insurance.

“As you’re young and just starting out, you don’t want to be in debt and you want to keep out of debt — and I think that’s great,” he says.

“So we’re going to be fair. We’re going to give you the appropriate wage for your work.

Where do you find young technicians to employ at your dealership?

We’re not going to only pay you $19 an hour because you’re only 20 years old. There is a job to do and we want our employees to know we’ll compensate them accordingly.”

High school vocational schools

its employees work 40 hours a week, from 7:30 a.m. to 4 p.m.

Dedicated vocational schools

Flat rates may be a repellent for some younger technicians, according to Chapman.

Other tire dealers

12%

“I am confident I’d have a mutiny if I asked my people to work past 4 p.m. or work on a Saturday,” he says with a laugh.

Tire retailers (big box stores)

“I think a lot of the younger techs got scared out of the tire industry by a flat rate or being worried that the job wasn’t going to provide for them. I think we take a pretty strong stance there to make sure they’re in charge of their own paycheck.

*Data from MTD's LinkedIn.

“The harder they work and the more they produce, the more they make.”

GENERATIONAL IMPACT

“We’re at the point in time where we must grow our talent instead of looking for it,” says Ward, who adds this is one reason why it’s so important to reach out to and hire younger employees.

46%

“Younger techs are more open to change and they adjust and adapt quicker, whereas older technicians tend

How do you retain younger technicians at your tire dealership?

Flexible hours/ schedule

All four tire dealers agree that work-life balance is a main motivator for younger technicians, too.

“When they start, younger technicians seem to be driven by salary,” says Konde.

“But some are definitely more interested in having lots of free time — especially on Saturday nights and during football season.”

Ward believes a big reason why young technicians like working at Chapel Hill Tire is because the dealership is closed on weekends.

Chase says this desire for more off-time is the reason Eastern Tire & Auto cut back on its operating hours.

“We used to work 50 to 60 hours a week — six days a week, from 7 a.m. to 6 p.m.,” he explains.

For the past three years, Eastern Tire & Auto has been closed on Saturdays and

to get stuck in their ways and become resistant to change,” he explains.

Konde agrees that younger technicians are more flexible when it comes to learning new technologies and techniques, but says it’s up to tire dealership owners and managers to learn about their employees’ work and career objectives.

“It’s important for managers to find out their technicians’ ‘why.’ What are their goals? Is working as a tire technician a main goal or is the plan to do (only) this in the short-term?

“Once you know their ‘why,’ then you can work to create a schedule or plan that works to the benefit of the company, but also allows the tech the time that they need to achieve their personal goals.”

Chase says understanding employees’ motivations is critical, adding he is “cautious on giving advice because I don’t

MTD March 2024 22

Weston Chapman, owner of Rapid City, S.D.-based Black Hills Tire, says young technicians often need more monitoring and guidance to ensure they are meeting their goals.

Photo: Black Hills Tire

(PTO, health) Tech compensation packages Other 37% 12% 46% 5% 0 10 20 30 40 50 30%

Enhanced benefits

12%

*Data from MTD's LinkedIn.

want anyone to tell me how to run my business. So I’m sure people don’t want me telling them how to run theirs.

“With that in mind, I think the trick for managing younger employees is to do everything you possibly can to satisfy (them) while (meeting) the demands of your customer base.”

This can be done in a number of ways, according to Ward.

He says managers should be intentional when developing younger technicians by giving them “regular meetings and having scheduled re-occurring meetings to discuss their progress and growth.”

It’s also important, notes Chapman, to celebrate young technicians and introduce them to the “more exciting parts of the industry.

“We have many technicians who work for us right now who are in vocational schools on a scholarship we provided for them.

“Once these younger technicians graduate from their auto tech program, we take them to the SEMA Show. That’s a pretty cool reward for a 21- or 22-year-old kid.”

Chapman took two recent auto tech graduates who recently turned 21 to the 2023 SEMA Show.

“It absolutely blew their mind,” he says. “We were worried taking recently turned 21-year-olds to Las Vegas for the first time, but by the time we got done walking through SEMA every day, they were so tired they went back to the hotel and went to bed!”

Konde notes it’s also important to be realistic while understanding this “information era that we live in.

“It may not be reasonable to ban the use of cell phones during a shift, but you can make a rule not to use the phone while dealing with customers to avoid error and distraction,” she says.

According to Konde, the most important thing to keep in mind when managing young technicians is to “treat them with the same level of respect as you would anyone else, regardless of their age.

“These younger technicians have ideas and valuable input to offer, as well,” she adds.

“This is an amazing industry,” says Chapman, “and we are proud to be a part of it and excited to get young people into it.” ■

www.ModernTireDealer.com 23

Mobile equipment that fits. Mobile equipment that produces.

on the road. hunter.com/mobile-service Scan or visit 2403MTD_Hunter.indd 1 2/20/24 11:15 AM

Get your show

Chapman says that once his younger technicians finish tech school, he takes them to the SEMA Show.

Photo: Black Hills Tire

Winter tires

“Our compounding technologies continue to evolve to meet the needs of our customers in severe winter weather conditions,” says Philipp Schrader, product manager for touring and U.S. winter tires, PLT, Continental Tire the Americas LLC.

Big trends in winter tires

WILL ALL-WEATHER TIRES BITE INTO WINTER TIRE SALES?

By

Madison Gehring

For many consumers, the world of winter tires can be a complicated one to understand and with the rise of all-weather tires, it may get even more complicated.

MTD recently asked tire manufacturers to discuss the latest winter tire trends and technologies and if they see all-weather tires impacting winter tire sales. (Most respondents said they believe winter tires make up less than 2% of the U.S. replacement passenger tire market.)

MTD: What new trends or technology are you seeing in the winter tire segment?

Brandon Stotsenburg, vice president of automotive division, American Kenda Rubber Co. Ltd.: e North American winter tire industry has been changing based on the recent di erences in the climate, with temperature and snow totals deviating from established norms from the last 50 years. It has also been in uenced by updates in

technologies which now allow all-season tires to match many of the characteristics necessary for most winter performance needs.

Kenda has a different approach for the United States and Canadian markets. In the U.S., Kenda believes most consumers will have their winter driving needs met by utilizing four-season (4S) tires o ering 3-Peak Mountain Snowflake (3PMS) certi cation. In most parts of the U.S., winter has lower temperatures with slush, enhanced rain and intermittent ice and snow. Kenda o ers its Vezda Touring 4S for small SUV and performance touring cars.

“Based on our estimates, winter tires make up around four million units of the U.S. retail replacement tire market annually,” says Karl Jin, divisional head, product and pricing, PCLT, Apollo Tyres Ltd.

In addition to the four-season products o ered in the U.S., Kenda will be o ering dedicated winter tires for the Canadian market that has more severe winter conditions and more need for those tires.

Karl Jin, divisional head, product and pricing, PCLT, Apollo Tyres Ltd. (Vredestein): Tire companies are continually working to improve winter tires by focusing on safety, tread wear, sustainability and driving experience. Some of the advancements in material research include advanced silane, bio-based oils, hydrocarbon resins, special types of silica and sustainable materials. Design-based technologies like 3D sipes and innovation in tread patterns are also being employed to enhance winter tire performance.

MTD March 2024 24

Photo: Continental Tire the Americas LLC

Photo: Apollo Tyres Ltd.

Winter tires

We do see smart technology/sensors in the commercial space today, but as an industry we’re still working to develop a compelling value proposition for this type of technology among consumer tires, including the winter segment.

Philipp Schrader, product manager for touring and U.S. winter tires, PLT, Continental Tire the Americas LLC: Sensor technology is certainly something we monitor closely. In the passenger and light truck segments, this will most likely be driven by OEM requirements moving forward.

Studdable tires continue to represent a significant, important portion of the snow tire market. Driven by consumer needs and regulations, the need for a premium studdable winter tire continues to be an important driver of new technology and tire design.

Ian McKenney, senior product manager, Bridgestone Americas Inc.: Since the 1980s when studded tires were outlawed in Japan and parts of the U.S., the winter tire industry has continued to focus on innovation in order to not compromise on performance when developing non-studded versions. Bridge stone has solidified itself at the forefront of winter tire innovation and our Blizzak tire line remains an industry leader today because of our specialized design technology.

Blizzaks feature Bridgestone’s patented Multicell Technology, which removes the thin layer of water from ice, allowing the rubber to grip the ice. This technology is comprised of next-generation compounds that feature silica enhancements, improving grip on snow and ice.

Lou Monico, vice president of sales, Giti Tire Canada: The winter tire industry is being influenced by smart technology, consumer preferences and the need to adapt to extreme weather events and changing climate patterns. The integration of sensors and smart technology in tires is a significant trend, along with a focus on improving fuel efficiency and traction to meet consumer demands and address environmental concerns.

“The new Goodyear Ultra Grip Performance 3 tire, available in fall 2024, features a directional tread pattern to disperse water and slush out the side of the tire to increase grip in wet and slushy conditions,” says Michiel Kramer, director of product marketing, Goodyear

Additional key features of the Blizzak line are its 3D zigzag sipes with block stiffness control. The interlocking sipes on the tire tread provide the biting edges needed for winter performance while maintaining the pattern’s stiffness. Its block stiffness control allows lateral stability and performance in snow, ice, wet and dry conditions.

We are currently investigating smart technology/sensors and their value across all tire segments. Developing this technology could assist in tracking things like tire pressure, temperature, tire revolutions, etc. However, at present, there isn’t a high level of demand for this type of technology among general consumers.

Michiel Kramer, director of product marketing, Goodyear Tire & Rubber Co.: The definition of what it means to be a winter tire has changed. Consumers are asking for more out of their winter tires and Goodyear is bringing new technology and innovation to the market in response. Consumer needs are less about the back woods, off-roading applications with deep, deep snow and more about handling and control during a wide variety of snowy, icy, slushy and even wet conditions that consumers meet between the mountains and their homes. The new Goodyear Ultra Grip Performance 3 tire, available in fall 2024, features a directional tread pattern to disperse water and slush out the side of the tire to increase grip in wet and slushy conditions.

Moonki Cho, product manager, Hankook Tire America Corp.: Studded tires have become more and more popular, especially in northern Europe, with over-run regulations. For optimal performance, studded tires with specific winter technology are expected to be on the horizon and introduced in the North American market. Smart technology has shown its strength for tire products across various segments, not only winter tires. Integrating sensors along with other tire systems allows further tire technological analysis and development, enabling continued opportunities to refine the segment and improve performance for drivers.

Jay Lee, product marketing manager, Nexen Tire America Inc.: In regards to eco-friendly materials, there’s a growing interest to develop winter tires using more environmentally friendly materials. Manufacturers are exploring ways to make sustainable alternatives when it comes to traditional tire components. On the subject of improved tread designs, ongoing research and development has enabled more efficient and effective tread patterns for winter tires. Those designs aim to improve traction on snow and ice, as well as enhance overall performance in cold conditions.

MTD March 2024 26

“Winter tires are designed specifically to handle the challenges of driving in the most dangerous months of the year and offer specific benefits for snow, slush and ice,” says Ian McKenney, senior product manager, Bridgestone Americas Inc.

Photo: Bridgestone Americas Inc.

“While the rise of all-weather tires may influence consumer choices, it’s unlikely that exclusive winter tires will disappear entirely in the foreseeable future,” says Jay Lee, product marketing manager, Nexen Tire Americas Inc.

Photo: Nexen Tire America Inc.

Tire & Rubber Co.

Photo: Goodyear Tire & Rubber Co.

Two Machines. One Price. Limitless Performance. www.rangerproducts.com *Price valid until March 31st, 2024. **Free shipping to direct shipping points within the 48 contiguous United States only. © 2024 BendPak Inc. Ranger Products is a registered trademark of BendPak. Revolutionize your tire and wheel service center with the ultimate pairing of precision and efficiency. Our combos redefine the standard, bringing you cutting-edge features without the hefty price tag. Elevate your services, amplify your efficiency, and see a direct impact on your profits. Don’t miss out on this opportunity to upgrade your workshop to the next level of performance. Connect with us at 1-800-253-2363 to speak with our experts or explore our combo offerings at www.bendpak.com. Discover the innovation, efficiency, and satisfaction that only Ranger can deliver – brought to you by BendPak. Tire Shop Package Includes: (1) DST30P Wheel Balancer + (1) R980AT Tire Changer + (1) Tape Wheel Weights Blk. & Slv. 1400 PC. 24 Month Warranty OEM Approved Max Performance Free Shipping** RimGuardTM Wheel Clamps Forged Steel Foot-Pedal Controls High-Volume Storage Wheel Weight Dispenser Stay Hold Brake Pedal Precision-machined, Hardened-Steel 40mm Shaft Easy-to-Read LED Control Panel Auto Hood Start Adjustable Bead Breaker Power Assist Tower Swing-Arm Bead Handling Tools SPEED Tire Shop Package SKU# 5140127 $8,320* Model: DST30P Model: R980AT

Winter tires

Some manufacturers are even exploring the use of nanotechnology to enhance the properties of rubber compounds in winter tires. is can lead to improved grip, durability and overall performance in challenging winter conditions.

However, due to environmental concerns and regulations in some regions, there is a shi toward developing nonstudded winter tires. is is so tires can provide excellent traction on icy surfaces without the use of metal studs.

As for smart-tire technology, integration of smart technologies into winter tires — such as sensors that provide real-time information on tire pressure, temperature and road conditions — has been a trend. is helps to enhance safety and performance.

ere’s also a shi toward utilizing digital platforms and connectivity. Integrating features such as tire monitoring apps that provide real-time information about road conditions are becoming more common.

“In the U.S., Kenda believes most consumers will have their winter driving needs met by utilizing fourseason tires offering 3-Peak Mountain Snowfl ake certifi cation,” says Brandon Stotsenburg, vice president of automotive division, American Kenda Rubber

Steve Bourassa, director of products and pricing, Nokian Tyres Inc.: e industry’s advance from snow tires to winter tires was relevant then and even more important today as we match tires to the extreme weather variability we see today. Luckily, advances in material technology, modeling simulation and more have allowed us to build winter tires that can get better in ice grip, rolling resistance and wet grip in each generation. ese technologies create a more well-rounded winter tire to tackle today’s weather extremes and variable conditions.

Kyle Sanders, director of product marketing and category management for TBC Corp.: Winter tires are being embedded with radio-frequency identi cation (RFID) chips and sensors, which has numerous implications for vehicles. RFID tags can store helpful information like the tire make and size, making it easily identi able, further accelerating the trend toward automation.

MTD: What consumer preferences are in uencing the design and performance characteristics of winter tires?

Ian Coke, chief technical o cer, Pirelli Tire North America Inc.: e winter segment is in part following the same trend as the rest of the market in terms of electric vehicle (EV) rim size. EV vehicles — with all their particular requirements — also require winter tires in certain climates and this therefore leads to the use of low rolling resistance compounds, as well as noise cancellation foam able to operate and perform in low temperatures.

Jared Lynch, director of sales, PLT, Sailun Tire Americas: Sailun continuously focuses on innovating and improving (its) winter tire tread designs and compounds, so current generations of Sailun winter tires last longer while still delivering superior traction and handling on snow, ice and dry roads.

Smart technologies like tire pressure monitoring systems and forward-collision warning systems should increase safety for consumers, too. Paired with modern winter tire tread compounds and tread designs, these smart technologies will provide consumers with extremely reliable winter traction, handling and overall safety during winter driving.

Chris Tolbert, director of sales, Trimax Tire: Changes in air pressure, compounds, etc.

Stotsenburg (American Kenda): From a performance perspective, Kenda has done extensive research that determined consumers strongly prefer four-season tires that will allow them to have the same performance in the summer as they expect in the winter. When they learn they can have enhanced wet performance while maintaining strong dry braking and wear, many consumers across the U.S. were interested in those attributes.

For aesthetics, Kenda’s research determined that consumers strongly prefer a symmetric or asymmetric tread design over a directional design. Kenda has relied on our Technical Center’s proprietary capabilities to design tires which look like all-season grand touring tires with the enhanced performance.

e tires need to match the speed ratings required for year-round driving, while providing the wear and look that will satisfy the majority of consumers.

Jin (Apollo/Vredestein): Consumer preferences are driving the increasing demand for winter light truck tires and those featuring the ice rating symbol, which indicates superior performance in severe winter and icy conditions. is trend re ects the necessity for vehicles to be operational in heavy snow and challenging weather conditions,

“Given the ever-changing climate patterns, it is imperative for winter applications to ensure superior grip and signifi cant shorter stopping distances in all winter driving conditions,” says Kyle Sanders, director of product marketing and category management for TBC Corp. (Pictured, the Sailun Iceblazer WSTX, distributed by TBC.)

MTD March 2024 28

Co. Ltd.

Photo: American Kenda Rubber Co. Ltd.

Sailun says it continuously focuses on innovating and improving (its) winter tire tread designs and compounds, so current generations of Sailun winter tires last longer while still delivering enhanced traction and handling on snow, ice and dry roads.

Photo: Sailun Tire Americas

Photo: TBC Corp.

NOW FIRESTONE TIRES ARE BACKED BY OUR INDUSTRY-LEADING GUARANTEE 90 DAY Restrictions and limitations apply. See FirestoneTire.com for more warranty details. FIRESTONE PRODUCTS ARE PROUDLY DISTRIBUTED BY K&M TIRE IS LOOKING FOR DEALERS. PLEASE CALL 800-686-1734 TO INQUIRE ABOUT THE CREATION OF AN ACCOUNT. WWW.KMTIRE.COM

Winter tires

making it crucial to equip them with genuine winter tires to ensure optimal safety and performance.

To help consumers choose the right tire for their driving conditions, winter tires are marked with snow grip and ice grip markings.

Performance winter tires are marked with 3PMS, indicating they are designed and certi ed to perform in severe snow conditions.

Performance winter tires are preferred for temperature ranges from 10 degrees Celsius to minus-20 degrees Celsius.

Ice/snow winter tires are marked with 3PMS and ICE markings, indicating they are designed and certi ed for snow grip and ice grip.

ey are the right choice for drivers who may face extremely low temperatures (up to minus 40) and icy conditions.

“Consumer demand for enhanced tread life in their tires has infl uenced the development of new products, including our recently launched Winter i*cept iZ3 tire, now available for preorder,” says Moonki Cho, product manager, Hankook Tire America Corp.

e ective tread patterns that o er increased traction in ice, snow and wet road conditions.

Kramer (Goodyear): At Goodyear, we think through the various winter driving conditions and work to create tires to address those unique challenges to meet the needs of consumers. e deciding (of) which winter tire is right for (the customer) should include matching the tire’s capabilities with the type of winter weather (they) typically encounter.

Cho (Hankook): Today’s winter tires are typically designed with a V-shape tread pattern to meet the performance needs in snow and icy conditions. By also implementing wider lateral grooves, this enables better water displacement, as temperatures can fluctuate and increase standing water potentials throughout the season. is, along with consumer demand for enhanced tread life in their tires, has influenced the development of new products, including our recently launched Winter i*cept iZ3 tire, now available for preorder.

McKenney (Bridgestone): With the increasing prevalence of electric vehicles today, we expect to see winter tire design evolve to adhere to EVs’ speci c operating conditions in snowy and icy conditions. For example, since EVs are considerably heavier than ICE vehicles, that impacts driving characteristics like braking and turning. We can anticipate ongoing innovations aimed at reducing rolling resistance, preserving range, extending wear life and mitigating noise performance speci c to EVs and winter tires in the future.

Schrader (Continental): Snow and ice traction, along with braking capabilities in inclement weather, are certainly the top performance requirements for winter tires. Our compounding technologies continue to evolve to meet the needs of our customers in severe winter weather conditions. Along with compounding, we develop innovative and

Lee (Nexen): Consumer preferences play a crucial role in shaping the design and performance characteristics of winter tires. For example, consumers prioritize safety in winter-driving conditions. ey o en look for winter tires that perform well in a variety of winter conditions, including snow, ice, slush and wet roads. On the manufacturing side, manufacturers focus on developing tread patterns and compounds that enhance safety in winter weather. Versatility is a key consideration and tire designs aim to provide consistent performance across di erent surfaces.

Consumers also look for durability and longevity as they want value out of their winter tires. Key features like longer lifespan and improved wear resistance all contribute to better longevity and provide value over the life of the tire. Lastly, consumers demand a quiet and comfortable ride experience.

Bourassa (Nokian): Consumers are less likely to choose a product that works well in only one condition. Consumers want the ultimate safety and traction in the worst weather conditions, but are not willing to sacri ce the other days. ey want comfortable and quiet, with good dry grip, OE style and handling and good wet grip for safety on warmer/wet days.

“If I am buying a winter tire it is because I don’t want to compromise safety or performance,” says Ian Coke, chief technical offi cer, Pirelli Tire North America. “This means winter tires have been specifi cally designed to combat the challenges of cold, wet, snow and ice conditions.”

Coke (Pirelli): Speci cally for winter tires, it would be the performance attributes. If I am buying a winter tire, it is because I don’t want to compromise safety or performance. is means winter tires have been specifically designed to combat the challenges of cold, wet, snow and ice conditions (with) compounds designed to operate and maintain grip in cold and snow, (plus) tread design using 3D sipes, which maximize the gripping edge, as well lock in snow for extra grip.

Lynch (Sailun): New vehicles use larger rim diameters (18-inch) and lower-pro le tires when compared to previous models. While aesthetically pleasing, these larger wheels and lower pro le tires create a sti er, less comfortable and noisier ride. As a result, consumers want quieter and more comfortable winter tires, along with improved winter traction. When designing modern winter tires, comfort, noise levels, longevity and traction must all be prioritized.

Tolbert (Trimax): e growth of all-wheel drive vehicles, CUV, SUV and light duty trucks (and) continued evolution of compound changes, especially with the changes of weather patterns.

Sanders (TBC): Consumers expect improved acceleration, handling and braking of their vehicles in winter conditions.

MTD March 2024 30

Photo: Hankook Tire America Corp.

Photo: Pirelli Tire North America Inc.

Winter tires

Kevin Nguyen, manager of product planning, Yokohama Tire Corp.: Consumer preferences for winter tires have remained consistent. They are looking for tires that are designed specifically to confidently handle all types of winter conditions.

According to Chris Tolbert, director of sales at Trimax Tire, “winter tires won’t go away” and are “important for driving situations in Canada and parts of the northern United States.”

MTD: Do you think the rise of all-weather tires will impact the winter tire segment in the long term?

generally displacing the traditional touring/highway all-season tire more than any other tire category.

Dedicated winter tires will continue to have their place in the market, though, as they provide an even more robust solution for ice and snow in areas that get heavy winter weather. But for consumers in areas that see occasional light to moderate snow, 3-Peak Mountain Snowflake-rated all-season tires (or all-weather) products

Stotsenburg (American Kenda): Kenda considers four-season tires to be appropriate winter tires in most North American climates and geographies. We absolutely see these tires as a more appropriate solution for the reasons previously described. However, dedicated winter tires have a specific purpose and should be available across the markets for applications that require their enhanced performance. Kenda does not see them going away.

Jin (Apollo/Vredestein): In the last five years, there has been a shift in the tire market where all-weather tires have grown in demand, while winter tires have seen a decline. Although this trend might suggest that all-weather tires have replaced winter tires, it is not that simple. A closer look at the data shows that a significant volume of all-weather tires are also being sold in areas with little or no snowfall, such as California and Texas. So while it is true that all-weather tires have taken some of the market share from winter tires, this is not the complete story. Other factors, such as the amount of snowfall and when it occurs, can significantly impact the sales of winter tires.

McKenney (Bridgestone): Looking at data from 2019 to today, the percentage of winter tires sold has remained steady each year. However, 3-Peak Mountain Snowflake rated all-season tires are a growing trend. As technology has improved, there’s been a rapid adoption of these types of products by consumers. These tires are

Schrader (Continental): Some winter tire sales will surely transition to all-weather products, especially in areas of the country that receive less snowfall and increased wet weather days. The 45-degree rule should still be followed — meaning that winter tires remain more pliable below 45 degrees due to the rubber compound that we utilize. This leads to shorter stopping distances in cold weather, even on non-snow-covered road surfaces. We do not believe that winter tires will be replaced by all-weather products completely, since there is still a strong need for severe winter weather performance.

Monico (Giti): The rise of all-weather tires may impact the winter tire segment in the long term, as consumer preferences and technological advancements continue to shape the industry as demand has increased in this segment, especially in urban markets.

Kramer (Goodyear): The growing size of the all-weather tire market will never completely eclipse the need for winter tires. All-weather tire performance is improving, including some all-weather tires now carrying the 3PMS designation. An all-weather tire will never offer the full performance capabilities of a winter tire (on) deep, packed snow or extreme icy roads. The same can be said for an all-weather tire in summer and high-performance situations. Unless you have the right tire for the conditions you face, there will be trade-offs. In addition, regional needs and government regulations mean that there will always be a need for winter tires. Some all-weather tires carry the 3PMS designation, but are still marketed as yearround tires. All-weather tires with a 3PMS designation offer more snow traction than a traditional all-season tire and they are a great alternative for customers who are not

willing to own two sets of tires. However, for someone who regularly drives in harsh and unpredictable winter conditions, such as during a winter travel advisory, Goodyear would still highly encourage motorists to consider a dedicated set of winter tires.

Cho (Hankook): All-weather tires introduce added flexibility for consumers to find a product that best suits their driving environments. In some areas, such as the Northeast, consumers may find that an all-weather tire that has an all-season capability with more bias toward winter performance may better suit their needs over a dedicated winter product. That undoubtedly has an impact on winter tire segment demand and perhaps even more prominently on the all-season segment in some respects.

Therefore, the extent of all-weather tires’ influence on winter tire demand can vary, contingent upon factors such as consumer preference, local climate patterns and tire innovations. Winter tires will remain an important seasonal product, especially for regions that experience extreme levels of snowfall and ice. That said, there has been a trend of milder winter seasons in the U.S., like we’ve seen in the Northeast, that may have an adverse effect on winter tire sales.

David Carpenter, winter product category manager, Michelin North America Inc.: So far, we’ve seen stable winter tire sales with the introduction of the all-weather tires. We’ve seen the shift in volumes come from all-season tires, not winter tires. It is possible to see a slight decline (in winter tire sales), but we anticipate that customers seeking maximum winter traction will continue to

MTD March 2024 32

Photo: Trimax Tire

The Michelin X-Ice Snow tire features V-shaped tread design that provides 100% of its contact patch for optimal grip; Michelin’s Flex-Ice 2.0 tread compound for use in a wide range of winter temperatures; Michelin’s EverGrip technology; and more, say Michelin North America Inc. officials.

Photo: Michelin Tire North America Inc.

Winter tires

choose dedicated winter tires. All-weather tires are a great solution for those in mild winter climates, but severe winter conditions demand a dedicated winter tire that performs in sub-zero temperatures, deep snow and ice.